Investing in real estate has been a time-tested strategy for wealth creation, and the current market presents a unique set of opportunities for investors. Whether you are a seasoned investor or someone considering entering the real estate market for the first time, there are compelling reasons to consider real estate investment now. In this blog post, we will explore the key factors driving the attractiveness of real estate investments in the current market, backed by relevant examples and statistics.

1.Historical Resilience: Real estate has historically demonstrated resilience during economic downturns. Even during times of market volatility, the demand for housing remains relatively stable.

For instance, during the 2008 financial crisis, while other asset classes suffered significant losses, real estate investments proved to be a safe haven for many investors, preserving their wealth.

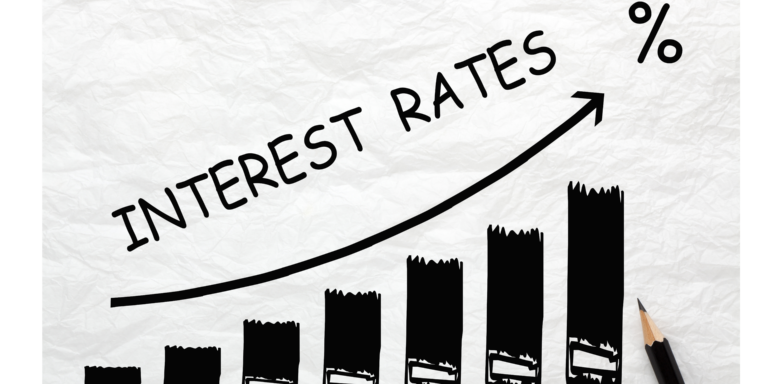

2. Cost of Waiting: While there has been a noticeable increase compared to rates in early 2021, this dynamic change signals an exceptional opportunity for savvy investors ready to embark on an exhilarating journey. While this rise might spark a moment of caution, rest assured that in the realm of real estate, opportunities abound.

Indeed, even as interest rates soar, there remains the promise of refinancing options and other strategic maneuvers that can potentially pave the way for rate reduction over time. So, uncover the hidden gems that align perfectly with your investment goals and aspirations, and seize the moment to secure a property that promises not just a home, but an unparalleled financial venture.

3. Rising Demand for Housing: The persistent demand for housing, particularly in urban areas and emerging markets, continues to drive real estate investment opportunities.

For instance, cities like Austin, Texas, and Nashville, Tennessee, have witnessed a substantial influx of young professionals and families, creating a robust demand for both residential and commercial properties.

4. Inflation Hedge: Real estate is often considered an effective hedge against inflation. As consumer prices rise, the value of real estate properties tends to appreciate, allowing investors to protect their purchasing power.

According to the U.S. Bureau of Labor Statistics, the Consumer Price Index (CPI) has increased by an average of 3.7% over the past 12 months, highlighting the importance of considering real estate investments as a hedge against inflation.

5. Diversification Benefits: Including real estate in an investment portfolio can enhance diversification and reduce overall portfolio volatility.

Real estate investments typically exhibit a low correlation with other asset classes such as stocks and bonds, providing a means to balance risk and potentially improve long-term returns.

6. Technological Advancements: The integration of technology in the real estate sector has streamlined various processes, making property management more efficient and cost-effective.

From virtual property tours to blockchain-based property transactions, technological advancements have improved transparency and accessibility within the real estate market, attracting a new wave of tech-savvy investors.

7. Tax Benefits: Real estate investors can benefit from various tax advantages, including depreciation deductions, mortgage interest deductions, and the ability to defer capital gains taxes through 1031 exchanges.

These tax benefits can significantly enhance the overall returns and cash flow from real estate investments.

Considering these factors, it’s evident that the current real estate market presents a compelling opportunity for investors to diversify their portfolios and build long-term wealth. Whether you choose residential, commercial, or industrial properties, real estate investment can offer both stability and growth potential in an ever-evolving market. Embracing the current market dynamics and leveraging these opportunities could lead to substantial financial gains and portfolio resilience in the years to come.

Want to start investing in real estate today?

Call us: 732.865.2163